Chinese e-commerce group JD.com and its newly acquired delivery platform Dada Group on Thursday published Chinese On-demand Consumption Trends Report 2021, a paper analyzing economic trends, opportunities and challenges in the country’s rapidly growing on-demand delivery and e-commerce sector.

JD.com bought up a 51-percent controlling share of Dada on March 22 by investing a further $800 million in newly issued ordinary shares, Dada revealed.

The paper details consumer demand trends, market penetration and growth rates based on billions of orders fulfilled by the Dada Now delivery platform and JDDJ, Dada’s on-demand retail platform, according to a group press release on Thursday.

The paper outlines key findings in the jargon-laden industry such as on-demand consumption, out-of-home and out-of-hours spending, omnichannel retailing, on-demand services and “minutes-level” delivery.

As a partnership between Dada Group and JD.com, JDDJ is a grocery delivery unit acquired in 2016 by Dada from JD.com that brings online traditionally more offline retailers like supermarkets, flower shops and beauty brands.

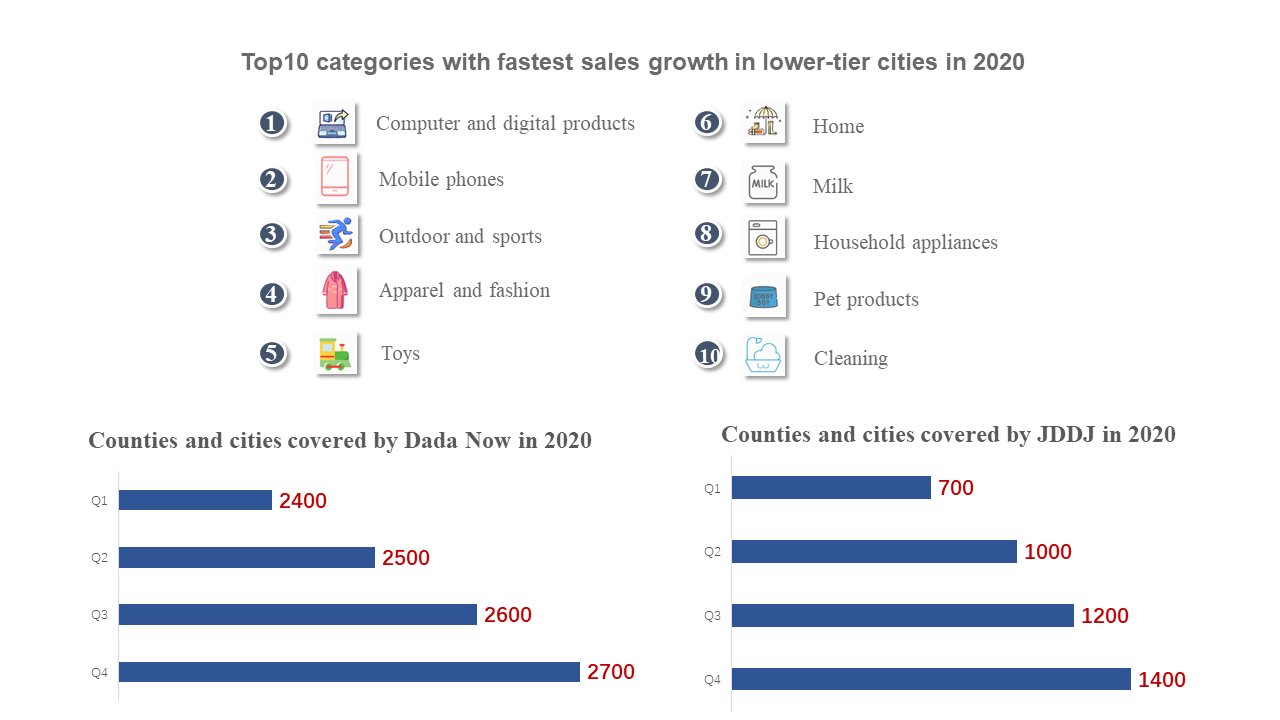

Dada Now, an intracity courier service, offers one-hour delivery for groceries, cosmetics, electronics, smartphones and medicines in more than 2,700 cities and counties.

On-demand consumption

The onset of the coronavirus pandemic and stay-at-home mandates drove widespread consumer adoption of on-demand delivery for daily household products, the press release said.

Fresh food remained the largest segment of on-demand delivery or 70 percent of daily consumption, according to a JDDJ user survey. Electronics, beauty products and clothes surged in 2021. Dairy products grew 120 percent year-on-year, personal hygiene 114 percent, snacks 91 percent, maternity and baby care 90 percent.

Millennials make up 50 percent of the on-demand economy, with females born after 1980 the dominant consumers, or 67 percent of the on-demand market.

Male consumers jumped to 33 percent in 2021, up from 25 percent in 2018. The proportion of users older than 40 increased to 28 percent in two years, up from 22 percent in 2019.

On-demand consumption is increasingly penetrating lower-tier cities, particularly the midwestern region of China where residents are demanding one-hour “hyperlocal” e-commerce delivery, the paper said.

In the fourth quarter of 2020, the gross merchandise value of JDDJ in lower-tier cities soared 150 percent year-on-year. In 2020 alone, the proportion of users in lower-tier cities increased 26 percent.

Ninety percent of merchants with JDDJ for over a year saw sales double year-on-year in the 415 (April 15) Anniversary Shopping Festival targeting more than 1,500 cities and counties across China.

The top three regions for on-demand consumption orders were South, North and Southwest China, accounting for nearly 70 percent of all orders. Orders in Southwest China accounted for nearly 20 percent, overtaking East China to rank third.

On-demand spending

Driven by easing lockdowns and connecting people to a wider array of products, post-pandemic on-demand consumption in China experienced a shift from households (74 percent) to workplaces (8 percent) and educational institutions (3 percent), the paper said.

Demand for 24/7 on-demand services and late-night (12 pm-2 am) businesses served a new wave of customers seeking reliable delivery service outside of traditional business hours.

Fueled by the integration of traditional e-commerce with offline retailers and on-demand retail platforms, omnichannel retailing reportedly meets a customer demand for more diverse shopping experiences.

One-hour delivery is also emerging as a channel for supermarkets and grocery chains to win business, the paper said. Offline retailers and brand owners are cooperating with on-demand platforms like JDDJ and Dada Now to establish delivery channels for their customers.

JDDJ is providing online delivery services for high-value orders as on-demand platforms have started bringing mobile phone trade-in services to customers’ doorsteps, saving the time and effort of visiting the retail store.

“Minutes-level” delivery

So-called "minutes-level” delivery is what the paper calls a “hyperlocal e-commerce process” whereby users place an order at a “digital neighborhood store” based on its GPS location. The courier picks up the goods and delivers them within minutes to the user’s neighborhood.

Dada is promoting a one-hour delivery service to consumers in more than 2,700 cities and counties across the country. Working with JDDJ, Dada has reduced average delivery time for on-demand orders by 17 percent compared with 2019, with the fastest deliveries taking less than 10 minutes, the paper said.

“The unprecedented growth of China’s on-demand economy in recent years, particularly its accelerated momentum through COVID-19, is revolutionizing consumer behavior across China,” He Huijian, Dada Group vice president, was quoted as saying in the release.

“The rise of on-demand, hyperlocal one-hour delivery of goods has transformed the retail industry and increased consumers’ expectations for a best-in-class shopping experience.”

He noted that alongside consumer demand in first- and second-tier cities is a large and rapidly growing demand in lower-tier cities where “retailers, on-demand retail platforms and delivery services are increasingly competing for higher speed, flexibility and convenience across the on-demand economy.”

With millions of riders across thousands of cities and regions in China, He said, “Dada Group is actively working to meet this demand and we are excited to continue our growth as we expand to new geographies and enter new partnerships with stores, retailers and brands.”