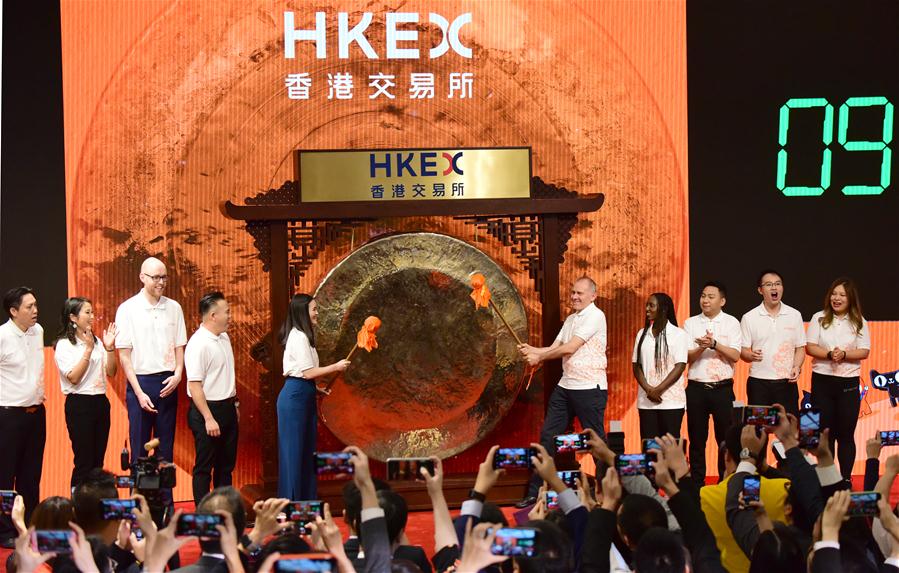

Guests attending a ceremony of Alibaba's debut on the main board of Hong Kong stock exchange in Hong Kong, south China. Chinese e-commerce giant Alibaba Group made a strong debut on the main board of Hong Kong stock exchange, November 26, 2019. (Photo: Xinhua)

HONG KONG (Xinhua) -- Chinese e-commerce giant Alibaba Group Holding Ltd. made a strong debut on the main board of Hong Kong stock exchange Tuesday in one of the world's largest initial public offerings (IPO) this year.

Opening 6.25 percent higher than its IPO price of 176 Hong Kong dollars, shares of Alibaba sustained the robust trend throughout Tuesday's session and ended up 6.59 percent at 187.6 Hong Kong dollars by market close.

The Hangzhou-based group has issued 500 million shares plus an over-allotment option of 75 million additional new shares to raise up to 101.2 billion Hong Kong dollars (about 13 billion U.S. dollars) through the IPO, a record high so far this year that reinforces Hong Kong's status as an international financial center.

The IPO has also made Alibaba the first Chinese Internet enterprise to list in both in New York and Hong Kong, as well as the first overseas issuer to raise funds from the Hong Kong market through a secondary listing.

A "HOMECOMING" LISTING

For Alibaba, a listing on the Hong Kong bourse is coming home, as Hong Kong was the company's prior choice when it first planned IPO in 2014.

However, the Hong Kong Exchange's regulation at that time prevented Alibaba from listing with weighted voting rights structures, and the company eventually went public in New York with a record 25 billion-U.S. dollar IPO.

Five years later, Alibaba's Hong Kong listing was made possible because previous regulatory obstacles have been cleared following bold reform at the bourse last year that permitted listings of companies with weighted voting rights structures.

The Hong Kong Stock Exchange has also established a new framework for companies seeking to list in Hong Kong as the second venue, paving way for Alibaba's comeback.

Chief Executive Officer of Alibaba Group Zhang Yong expressed gratitude to the Hong Kong Exchanges and Clearing Limited (HKEX) for reforms and innovation in recent years that has made Alibaba's Hong Kong IPO happen.

"As a result of the continuous innovation and changes to the Hong Kong capital market, we are able to realize what we regrettably missed out five years ago," he said.

Zhang also said Tuesday's "homecoming" listing marked an important milestone for the company, which is celebrating its 20th founding anniversary this year.

Alibaba said it plans to use the net proceeds from share issuance to drive user growth and engagement, empower businesses to facilitate digital transformation and continue to innovate and invest for the long term.

Hong Kong is an important international financial and trade center, as well as a hub connecting the Chinese mainland and the rest of the world, Zhang said, pointing out that Alibaba's Hong Kong IPO would push forward its global march.

A VOTE OF CONFIDENCE

The success of Alibaba's IPO has reflected investors' confidence in China's new economy, especially the digital economy, as well as China's future development, according to Zhang.

His optimism has been echoed by financial experts and market observers in Hong Kong, who were impressed by the popularity of Alibaba's IPO.

Ronald Wan, a seasoned financial expert in Hong Kong, said the strong debut of Alibaba as a secondary listing on the Hong Kong market indicated firm market confidence in Alibaba itself, the Chinese economy and Hong Kong as China's international capital market.

Prior to its Hong Kong debut, Alibaba's IPO has been oversubscribed by more than 40 times from institutional and individual investors globally.

Alibaba has announced its global strategy for the next five years and expects that more than 1 billion Chinese consumers will drive consumption of 10 trillion yuan (1.43 trillion U.S. dollars).

Online shopping platforms owned by Alibaba shattered records during China's Singles' Day shopping spree on Nov. 11 this year. The total sales reached 268.4 billion yuan (38.16 billion U.S. dollars), marking a year-on-year growth of about 25.7 percent.

Zhang also noted that Alibaba has full confidence in Hong Kong's future development and expressed hopes that his company could contribute and participate in the future of Hong Kong.

A STRONG SHOT IN HONG KONG MARKET

For Hong Kong's capital market, Alibaba's comeback following the major regulatory changes last year has served to prove the reform a success and injected a strong shot to consolidate Hong Kong's status as a key international financial market.

Charles Li, chief executive of the HKEX, said he believed that after Alibaba's Hong Kong listing, more Chinese enterprises listed overseas would return to the Hong Kong market.

Li said he expected that Alibaba, together with another Hong Kong-listed new economy giant Tencent, to paint a rosy future for Hong Kong's capital market.

Cliff Zhao, chief strategist at China Construction Bank International, said Alibaba's Hong Kong secondary listing is very likely to be followed by other Chinese tech companies listed on overseas markets.

Attracting more tech companies could help improve the structure of Hong Kong's stock market, which has been dominated by traditional industries and would in turn better serve China's economic development and structural transformation, he said.

Over 330 tech companies, including information technology providers, pharmaceutical companies and online retailers, are now publicly traded in the Hong Kong market, accounting for only 13.5 percent of the total.

George Yang, chief macroeconomist of Prime China Securities Limited, said as a world e-commerce leader, Alibaba's comeback to Hong Kong would also lure more enterprises of the new economy to raise fund from the Hong Kong market.

Zhao agreed that Alibaba's IPO would make the HKEX more attractive and competitive among other bourses and further consolidate Hong Kong's global role as an international financial center.

The HKEX welcomed 84 new companies in the first six months of this year, raising about 69.8 billion Hong Kong dollars (about 8.93 billion U.S. dollars) through IPOs. Of the 84 new companies, 17 were new economy firms and three were biotech companies, representing about 40 percent of the total funds raised.