XI'AN, June 1 (Xinhua) -- China will promote the standardized development of supply chain finance, effectively broaden the financing channels for micro, small and medium-sized enterprises and ensure more funds flow to the real economy, according to the central bank.

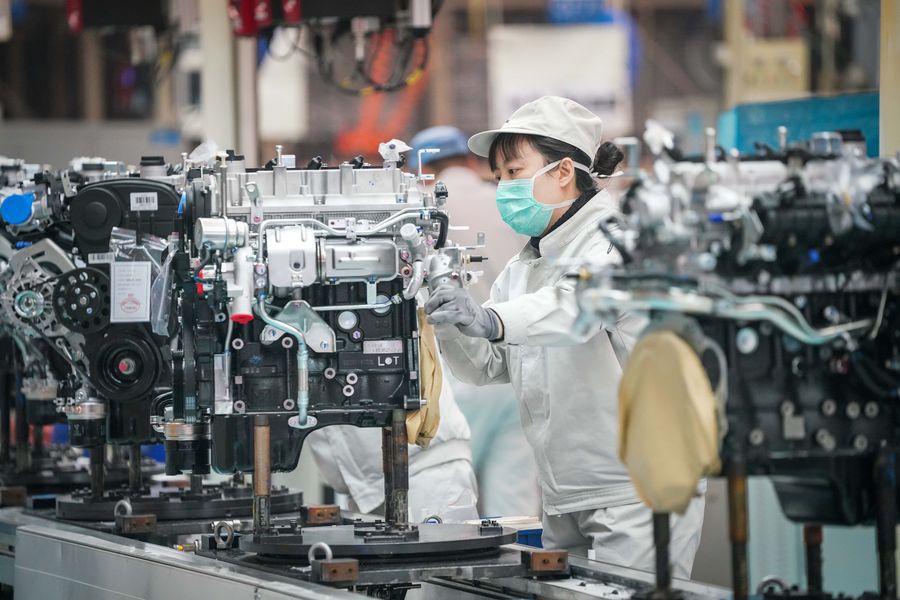

A woman works at a factory of the Harbin Dongan Automotive Engine Manufacturing Co., Ltd in Harbin, capital of northeast China's Heilongjiang Province, March 10, 2020. (Xinhua/Wang Song)

Information sharing is yet to be realized among financial institutions, major enterprises, government departments and third-party institutions, the standardization and transparency of accounts receivable financing need to be further improved and risks of fraudulent transactions still exist, Wang said at the just-concluded China Finance 40 Qujiang Forum.

In the next step, efforts should be made to improve the supply chain billing platform, establish a credit mechanism and prevent risks of supply chain finance, he said.

Chinese authorities issued a guideline in September last year, putting forward a slew of policy requirements and measures to regulate the development and innovation of supply chain finance, construct the supporting infrastructure, improve the policy supporting system, and prevent risks.