The National Internet Finance Association of China issued a risk warning letter late on Friday telling "unqualified institutions" to immediately stop offering loans as Beijing steps up a crackdown on the micro-loan sector to fend off financial risks.

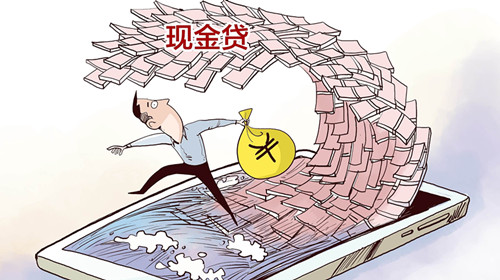

The one-trillion-yuan (151.5 billion US dollars) short-term, unsecured lending sector, known as "cash loan" in China, has been accused of charging exorbitant interest rates and violent debt collection practices.

In Friday’s warning letter, the Internet Finance Association of China, a government-backed industry group, said unqualified micro-lenders are disrupting economic and social orders and must stop lending immediately.

"Some institutions are not qualified to issue loans but have used false promotion to attract clients, conduct violent debt collection, and charge extremely high interest rates and fees, causing financial risks and social problems in some regions," it said in the letter released on its website.

Qualified lending institutions should also increase self-discipline, charge interest rates at a reasonable level, and increase information disclosure, the association added.

The companies are not allowed to conduct violent debt collection or harass unrelated people, it said.

The warning letter also called on financial consumers to increase their business knowledge and learn about their rights and interests when purchasing financial products and services.

"For unfair loan contracts, consumers can withdraw, change and use legal means to safeguard their legitimate rights and interests through civil judicial means. Consumers should report to the relevant regulatory authorities or China Internet Finance Association when finding illegal financial activities," the letter noted.

"In the future, regulation will focus more on license requirements for financial service institutions and make sure regulation covers every kind of financial activity," Ben Shenglin, dean of Academy of Internet Finance at Zhejiang University said.

"Central and local financial authorities' regulatory rights will also be more clear." he added.

"Right now, the incompetence of the local financial regulatory authorities and the lack of regulatory measures are a drawback. This problem is expected to ease with more regulatory technologies in the future," Ben said.

Illustration against online lending licenses. (Photo: VCG)

China has started to take steps to rein in the loosely regulated Internet finance, and a series of tightened regulation notices were issued this week.

On Tuesday, a top-level multi-ministry body, tasked by the central government to oversee the Internet finance sector, issued an urgent notice to restrict granting of new approvals for micro-loan firms.

On Thursday, China’s central bank the People's Bank of China and China Banking Regulatory Commission (CBRC) held a joint meeting on the rectification process of web-based micro-loan businesses with local regulators from 17 provinces that permit such services.

(with inputs from Reuters)