Ant Group. (Photo: IC)

Chinese fintech giant Ant Group will raise $34.5 billion in dual IPOs in Hong Kong and Shanghai after setting the price of its shares on Monday, making it the biggest IPO in history.

The listing of Ant Group - which makes it the first IPO of a top 10 world-leading technology company in China's A-share market in three decades - will encourage the diversification of China's stock structure, and divert more institutional investment into China's new economy sectors, experts say.

The company's Shanghai-listed shares are priced at 68.8 yuan ($10.26) each. The goal for Ant is to raise 114.9 billion yuan through the IPO on the A-share market. As of 4pm on Tuesday, its IPO in Hong Kong recorded margin trading of around 63 billion yuan, equivalent to about 17.86 times oversubscription.

The price will push the fintech's valuation to $313 billion, larger than any traditional financial institutions such as Goldman Sachs.

The price in Hong Kong has been set at HK$80 ($10.32) each, and the shares are expected to start trading on November 5, though the company did not reveal when it would start trading at the Shanghai exchange.

Alibaba Group is expected to hold 31.8 percent of Ant's equity, or 31.2 percent if the underwriters subscribe for additional shares under the A-share issue and the H-share issue, the company said on Monday.

The listing of a top tier fintech company in China suggests that China's A-share market is becoming more mature and inclusive, according to Mei Xinyu, a research fellow at the Chinese Academy of International Trade and Economic Cooperation of the Ministry of Commerce.

According to public information, Ant Group is the only company to be listed with over $15 billion of revenue, as well as more than 20 percent operating profitability and more than 40 percent revenue growth.

"Internet companies of this size would normally choose to be listed in the US or Hong Kong a few years back," Mei said.

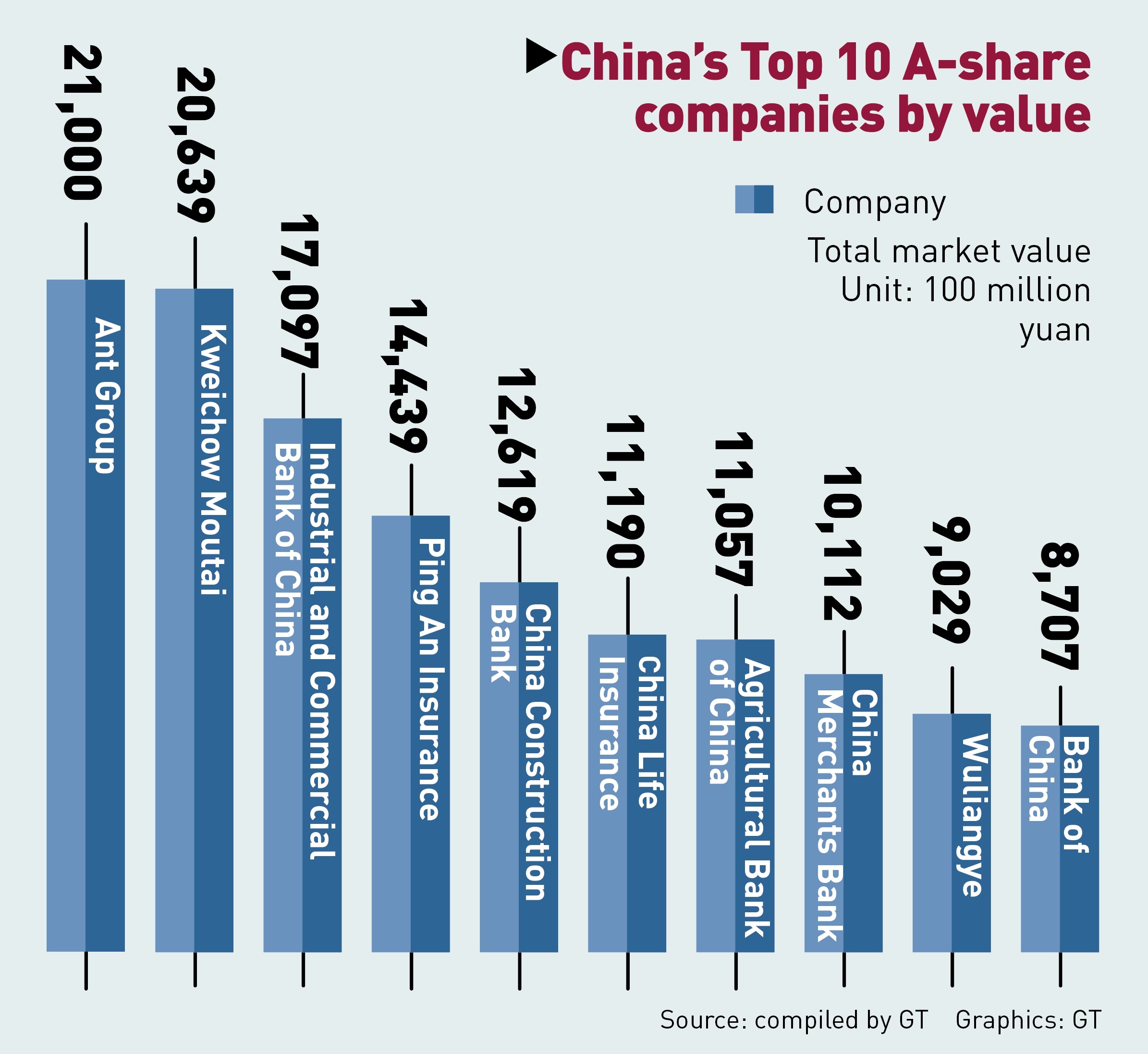

"Compared to more mature markets like those in Hong Kong and the US, top companies in China's A-share market are significantly more homogenous, making it less diverse and attractive for top investors," said Dong Dengxin, director of the Finance and Securities Institute at Wuhan University of Science and Technology.

"All the top 10 companies listed on China's A shares used to be in the traditional sectors, including liquor, banking and energy, whereas in Hong Kong, 4 out of 10 are in emerging sectors," Dong said.

The listing of Ant Group marks the transformation of China's A-share structure, and will divert more resources to the new economy sectors, making it more competitive with the world's leading stock markets such as the US, Dong added.

So far, the listing has attracted multiple high-profile investors. On Sunday, Chen Wenhui, vice chairman of the National Council for Social Security Fund, confirmed that the fund is actively participating in Ant's IPO.

Ant Group also revealed that China's Social Security Fund invested an additional 7 billion yuan to subscribe for more than 100 million Ant shares, causing it to become the second-largest strategic investor after Alibaba.

Other large institutional investors include China Investment Corporation, the Canadian Pension Plan, Government of Singapore Investment Corporation and Temasek.

It is noteworthy that Ant Group's decision to pursue dual IPOs in both Hong Kong and Shanghai was made amid the recent increase in tensions between China and the US, which is reportedly considering adding the fintech company to the Trump administration's growing trade blacklist.

The reasons behind the increasing appeal of China's stock market for top fintech companies are likely to be the relentless capital market reforms in recent years, including the shift to a registration-based listing mechanism to support new companies to go public in China.

In August, the first batch of 18 mainland enterprises went public on China's ChiNext board under the registration reforms, giving the board a 1.98 boost on the same day.

"For younger companies, which may have weighted voting rights and alternative company structures that do not conform to the traditional listing requirements, these reforms are encouraging," Dong said. "Chinese markets are also shifting to prioritize the company's revenue scale, making the market more inclusive, and easier for young fintechs to be listed."

For Ant Group, the listing in Shanghai will give it extra edge during a time of uncertainty, as the US increasingly scrutinizes Chinese companies listed there and threatens them with potential delisting, according to Zhou Yu, director of the Research Center of International Finance at the Shanghai Academy of Social Sciences.

"Ant Group's business is primarily in China, and we are excited about our growth prospects in the China market. Our mission is to contribute to economic growth and job creation through serving ordinary consumers and small businesses," the company said in a statement previously sent to the Global Times.

Graphics: GT