(Photo: CGTN)

As many as 601,000 barrels of Middle Eastern crude will be delivered to buyers from Sept. 3 to 7, the first physical settlement of the yuan-denominated oil futures contract through the Shanghai International Energy Exchange (INE).

Five companies are poised to make the delivery to buyers of the September crude contract that expired on Friday, as people are eager to see whether the delivery process will be smooth.

If the delivery goes well, it will cement investor confidence in the INE contract.

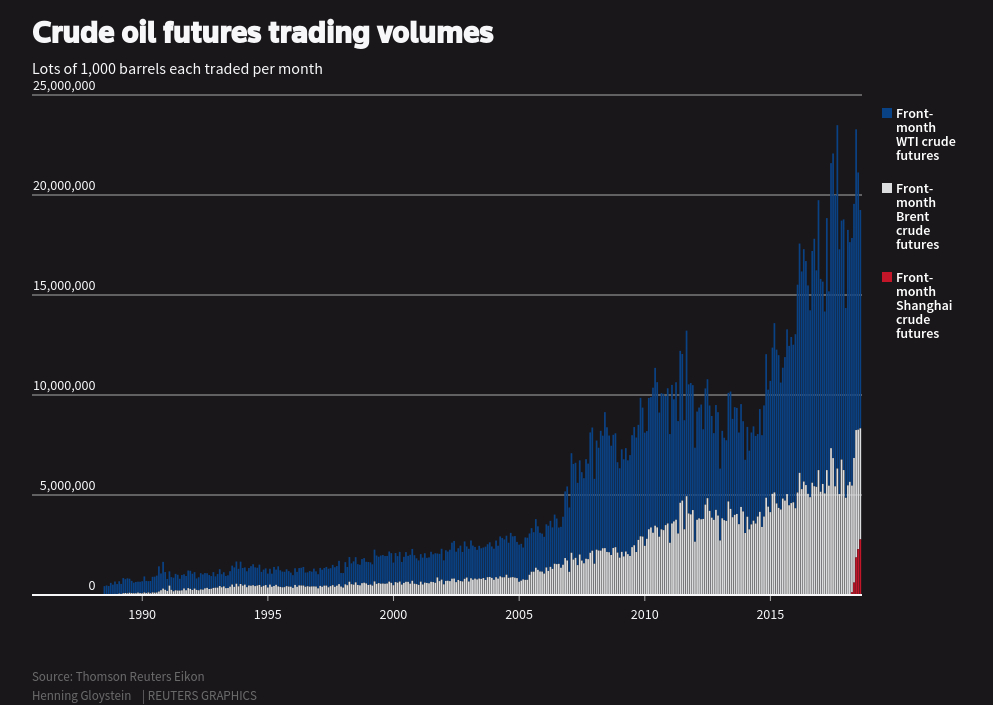

To tilt the global oil game on its axis, China, the world's largest oil importer, launched the long-awaited crude futures contract in March 2018. Since then, trade volumes have bypassed other crude futures, such as those that the Dubai Mercantile Exchange (DME) launched in 2007, though it is far from catching up with the global benchmarks, US West Texas Intermediate (WIT) and London's Brent.

(Photo: CGTN)

Analysts have flagged storage costs for buyers to transport the crude from tanks to their refinery as one of the problems that traders could face in the delivery mechanism of the INE contract.

The five companies include Chinaoil, Unipec, CNPC Fuel Oil, Zhenhua Oil and an unidentified private firm, according to the newspaper China Securities Journal.

Unipec, the trading arm of Asia's largest refiner Sinopec Corp, will deliver 201,000 barrels of Iraq's Basra Light crude to Sinopec-operated storage tanks at Ceze Island of eastern China's Zhejiang province.

Chinaoil, the trading unit of China National Petroleum Corp (CNPC), is set to deliver 100,000 barrels of Oman crude to storage tanks in the northeastern city of Dalian. In June, Chinaoil moved about half a million barrels of Oman crude oil into storage in Dalian, owned and operated by CNPC, to prepare for an eventual delivery against the INE contract.

CNPC Fuel Oil, Zhenhua Oil and the unidentified firm will each deliver 100,000 barrels of Basra Light into a storage farm in the port of Zhanjiang, off the south China's Guangdong Province.

Among the three delivery points, only the Zhanjiang storage is a standalone facility with no pipelines to nearby refineries.

It is still not clear who will take the deliveries.