NEW YORK, Aug. 4 (Xinhua) -- While the US economy is still trying to make a full recovery from the 2008 financial crisis, new uncertainties may put the US and the global economy in danger once again, an expert told Xinhua in a recent interview.

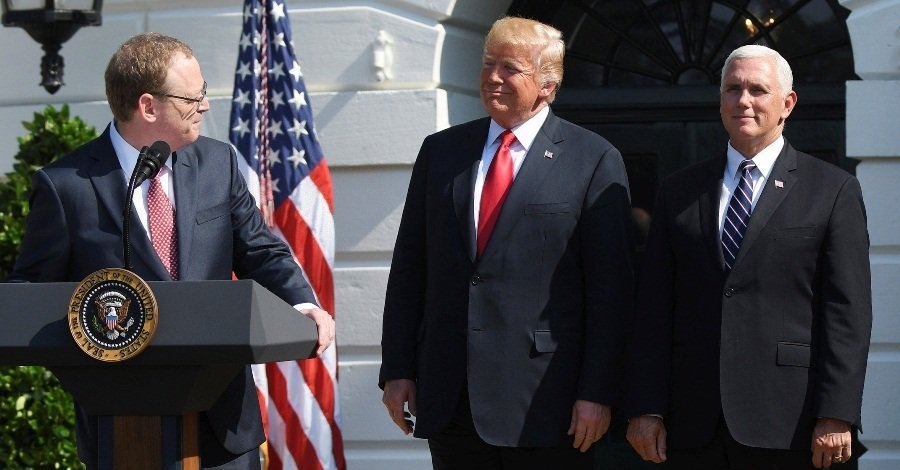

White House economic advisor Kevin Hasset, makes remarks after USPresident Donald Trump joined by Vice President Mike Pence made a statement about the economy on the South Lawn at the White House in Washington, the US, July 27, 2018. (Xinhua)

Even though it's very difficult to predict the future, yet "with quantitative easing (QE) ending, risks mounting in an overvalued stock market... a more disruptive outcome is quite possible," Stephen Roach, former chairman of Morgan Stanley Asia and a senior fellow at Yale University's Jackson Institute for Global Affairs, said .

STRUGGLING FOR RECOVERY

The US economy has been struggling to make a post-2008 global crisis recovery after the Federal Reserve (Fed) started the QE program to stimulate the economy and increase liquidity.

"The absence of a classic vigorous rebound since the global financial crisis means the global economy never recouped the growth lost in the worst downturn of modern times," Roach said.

The QE program, which is seen by Roach as the boldest policy experiment in the modern history of central banking, was initially very successful in arresting the financial crisis in 2009. However, subsequent rounds of QE were far less effective and posed threats to sustainable economic growth.

The excess liquidity spilled over into both equity markets and the bond market. While essential for income-short American consumers, it made the real economy overly reliant on QE support of asset markets, Roach said.

QE also exacerbated America's already severe income disparities. According to the Congressional Budget Office, virtually all of the growth in pre-tax household income over the QE period (2009 to 2014) occurred in the upper decile of US income distribution.

QE also blurred the distinction between fiscal and monetary policy, as Fed purchases of government securities tempered the market-based discipline of federal spending.

Though this was not a big deal when debt-service costs were repressed by the persistently low interest rates of the QE era, with federal debt held by the public nearly doubling between 2008 and 2017 from 39 percent to 76 percent of GDP, and likely to rise considerably in the years ahead, "what is inconsequential today could suddenly take on considerably greater importance," Roach pointed out.

RISKS IN OVERVALUED STOCK MARKET

The current Shiller PE Ratio, which is based on average inflation-adjusted earnings from the previous 10 years, stands at 32.67, a higher level than in mid-2007, the brink of the subprime crisis.

Only twice in history has the ratio been higher than it is today - in 1929 , when the Great Depression started in the US, and in 2000, which saw the after effects of the Asia crisis, the dotcom bubble bursting and other crises.

"Those are not exactly comforting precedents," Roach said.

In an increasingly asset-dependent US and global economy, a sharp correction in the US stock market would be an especially worrisome development, he warned.

"The outlook for 2018 is far from certain," Roach said, "With tectonic shifts looming in the global macroeconomic landscape, this is no time for complacency."