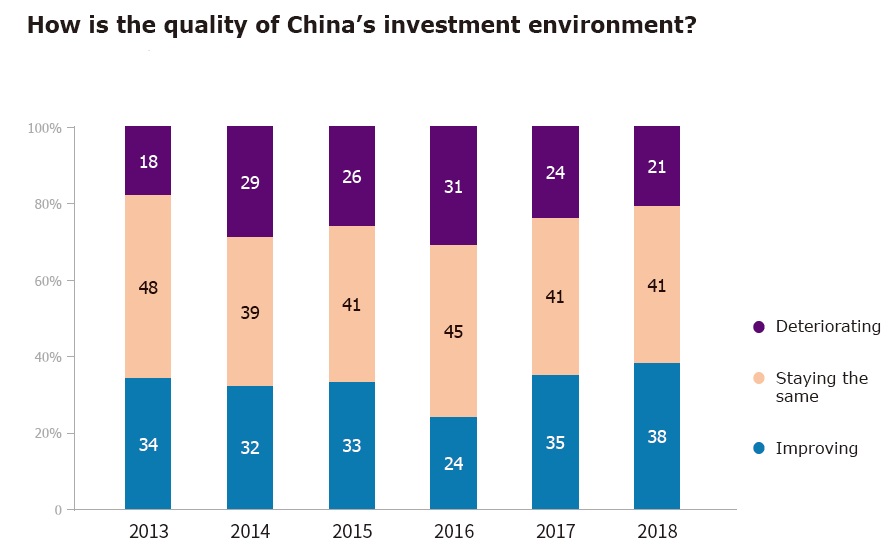

China remains a high priority market for the majority of companies; the American Chamber of Commerce in China (AmCham China) said its members continue to see improvements in the quality of China's investment environment, gaining 14 percentage points more than the low point in 2016.

Figures source: “2019 China Business Climate Survey Report” released by AmCham China on February 26, 2019.

Aerospace and healthcare services plus retail and distribution sub-sectors turned out to be the most optimistic, with no respondents reporting China’s investment environment as deteriorating, according to AmCham China’s latest survey on China Business Climate Survey that was released on Tuesday.

Mixed expectations

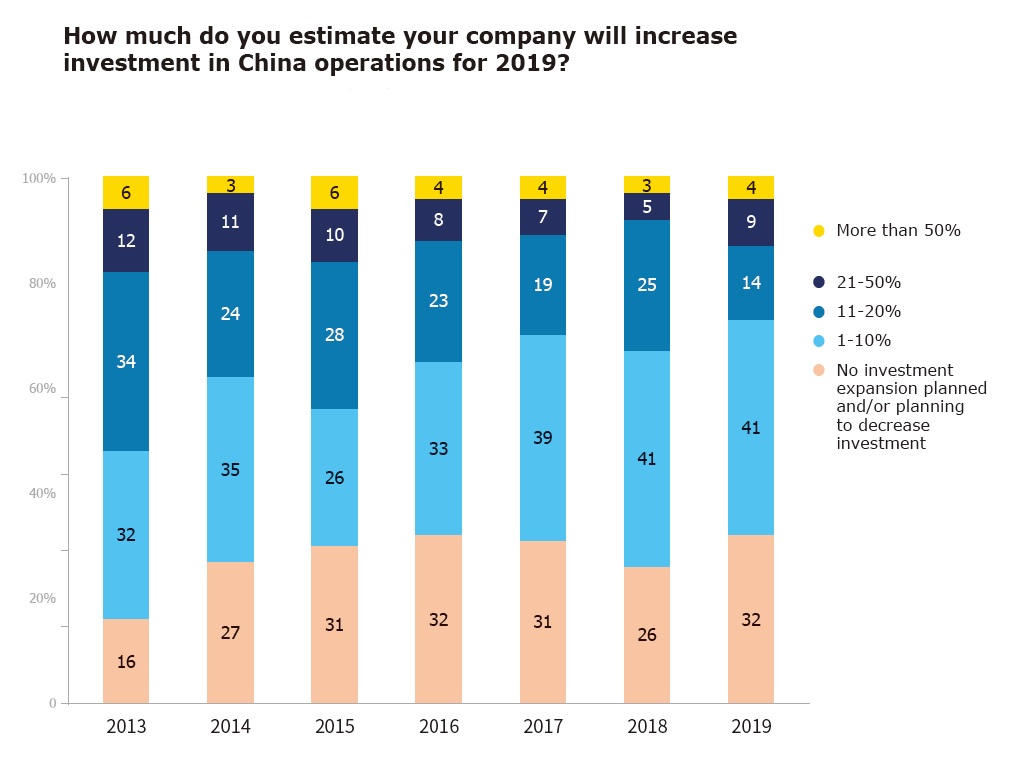

Meanwhile, there are mixed messages in the report, saying that the trend of slower investment expansion is expected to continue into this year.

Over 80 percent of member companies said they expected positive industry growth in 2019, though more than half said they could foresee their industry growing at no more than 5 percent, below the 6.3 percent that the Chinese government forecasted as the GDP growth rate for 2019.

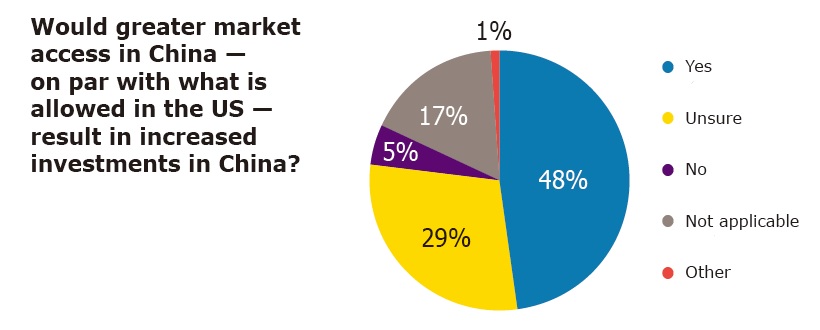

National treatment is voiced among the report’s respondents, as almost half of the respondents would consider increasing investment in China if its markets were as open as those in the US.

While almost 30 percent of members stated that they were unsure if market openness on par with the US had any effect on increased investment, citing other considerations including local product requirements, the level of competition and costs, the report noted.

“A number of government commitments or promises have not been implemented recently. They stay at the central level or are ignored in local enforcement or practices,” the report cited a senior manager in the education sector.

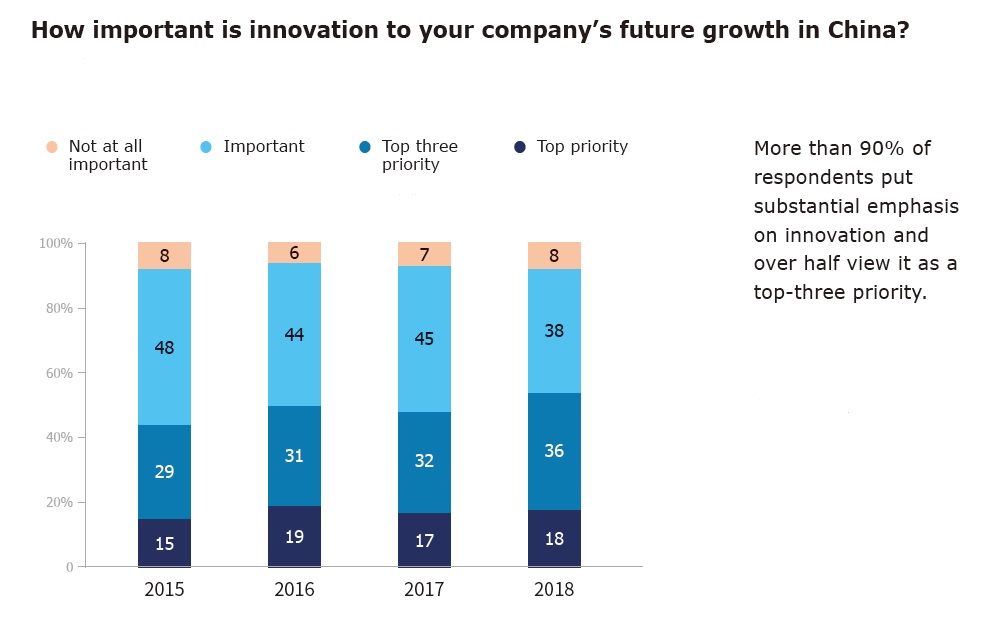

In terms of innovation and intellectual property right (IPR) protections, most companies (over 90 percent of respondents) prioritize innovation as the key to future growth in China, with high expectations to remove barriers such as relatively weak IP protection, insufficient talent and restrictive cyber security policies, which are enlisted as top factors.

AmCham China Chairman Tim Stratford at press release (Photo: Dong Feng/People’s Daily app)

When asked about the impacts of the shortened negative list in recent years, AmCham China Chairman Tim Stratford told the People’s Daily that even though the size of China’s negative list has been reduced, no impacts have been observed as the open sectors are not necessarily matching those that US enterprises are keen to enter with strong enthusiasm. “There is a high expectation that the negative list could move to that direction,” he said.

Time windows

Take the payment market in China for instance, Stratford pointed out that US enterprises missed the golden opportunity with the opening-up policy being offered after the payment eco-system was developed soundly in the domestic market.

Niche insights

This years’ survey was conducted in a rather tight timeline, Partner in Risk Advisory at Deloitte Kevin Li told the People’s Daily, saying that the Chinese New Year fell earlier in 2019.

Only 314 respondents were covered in this edition. Li said that most of the respondents were based in North China.

The American Chamber of Commerce in South China on Monday reported that its members, mostly foreign-funded multinational companies, increased their reinvestment budgets in China this year, according to Xinhua News Agency.

Two hundred forty surveyed companies have increased their 2019 China reinvestment budgets through profits by a whopping average of 37.9 percent, an increase from 2018, cited the chamber's annual white paper on China's business environment and a special report on the state of business in South China.

Cover illustration: VCG