With Taiwan Semiconductor Manufacturing Co (TSMC) Chairman Morris Chang announcing his retirement on Tuesday, China's largest contract chipmaker has started its post-Chang era, searching for new growth opportunities.

Morris Chang (Photo: TSMC Annnual Report 2017)

TSMC founder and chairman Zhang Zhongmou, also known as Morris Chang, has retired. In his own words, he finally has time to play bridge.

After more than 30 years, Chang has built the Apple Inc. supplier into the world’s biggest chipmaker with a market value of $185 billion.

Mark Liu (Photo: VCG)

Chang’s retirement

Chang, who is 87 and regarded as the father of Taiwan's chip industry, will be succeeded as chairman by Mark Liu who has been co-CEO along with C.C. Wei since 2013, TSMC announced on October 2, 2017, Wei will become CEO.

The planned leadership succession will not change the company in a fundamental way, analysts said.

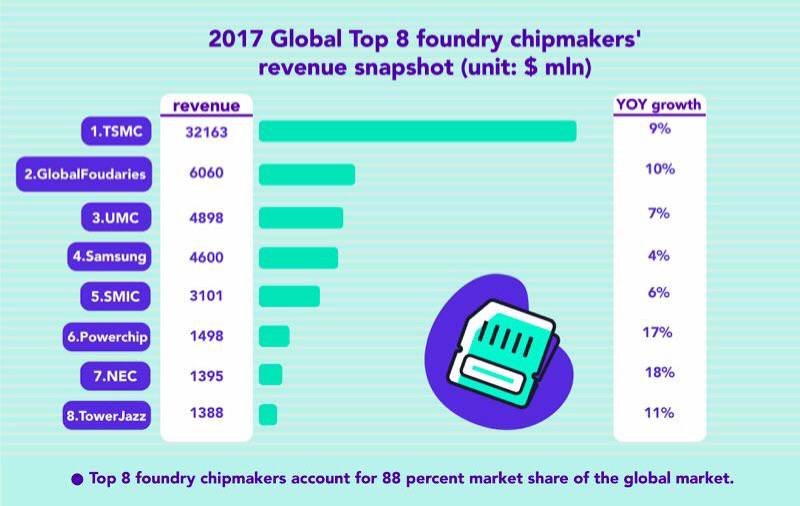

TSMC’s chip business controls 56 percent of the global market.

In addition to being the only supplier of iPhone's core processor chips, TSMC has a total of 465 clients around the world, including almost all of the world's major chip designers.

Many companies rely on the manufacturing process of TSMC to create advanced chips.

Chang founded TSMC in 1987 with a paid-up capital of $45 million and pioneered in contract chip manufacturing for chip design firms that don’t have their own factories. He has been its chairman ever since.

Change on the way

Since June 2017, Intel has caught up with TSMC with its market value exceeding the competitor. The gap between the two companies is widening, which hurts Chang’s legacy.

The change in leadership comes at a critical time as TSMC, which has thrived on booming demand for chips used in smartphones, now seeks to diversify its customer base and move into emerging industries such as artificial intelligence and autonomous driving.

The competition in the chip industry is getting intense and TSMC’s client structure is also transforming.

Japanese business outlet Nikkei reported that TSMC’s biggest account is Apple and its reliance on the Chinese mainland is increasing.

In 2017, Apple accounted for 22 percent of TSMC’s revenue while in 2015 and 2016 it was less by 5 to 6 percentage points.

It must also deal with the growing threat from Samsung Electronics, the world’s top memory chipmaker, which plans to triple its market share in the chip manufacturing business in the next four years by aggressively adding clients.

The succession plan has been in the works for years. Liu and Wei have held complementary posts since 2012 when they were chief operating officers before assuming the co-CEO role in 2013. Previously, they were senior vice president- Wei for business development and Liu for operations.

Liu studied electrical engineering and computer science at the University of California, Berkeley, while Wei pursued electrical engineering at Yale University. Both Liu and Wei have doctorates.

Chang, citing personal and family reasons, said that upon his retirement, he would not sit on board of directors and help manage the company.

Illustration: Xia Yurou/People's Daily app

Apple is also seeking to make its own chips, including processor chips, fingerprint chips and Bluetooth chips for Airpod wireless headphones to reduce dependence on suppliers.

The emerging players in the Chinese mainland such as SMIC might also provide a challenge to TSMC.

The chip manufacturing industry’s growth engine is transforming from PC and smartphone chips to Internet of Things fields. In its post-Chang era, TSMC will need to identify new business opportunities.

Since its foundation, TSMC has established an effective salary system and incentive mechanism. Besides a basic salary and quarterly bonuses, employees are entitled to rewards. They are also encouraged to hold on to stocks for more benefits. Such a policy might crack the talent outflow for awhile.