40 years after its birth, credit cards are still playing an important role in China, participating in trending social activities, including the shopping spree on the just-concluded Global Shopping Festival—better known as Double Eleven.

In this era of cashless society, it seems that cash payments are not as frequent as plastic and mobile payments, but it was not the case 40 years ago.

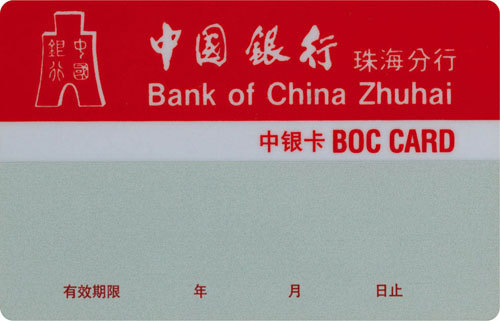

The first RMB credit card was issued by Bank of China’s Zhuhai Branch in 1985. (Photo: Bank of China)

The first credit card in China was not issued by China. It was brought to the country by the influx of foreign tourists at the beginning of the reform and opening-up. At that time, Bank of China was the only bank to provide the service. Later, its Guangdong Branch signed agreements with HSBC and American Express on agent services of credit card cash withdrawals.

After six years of cross-border cooperation, Bank of China became familiar with the credit card business process and modes of operation, which led to the issuance of the first RMB credit card—the BOC CARD—by Bank of China, Zhuhai Branch in 1985. The Great Wall Card designed to be used nationwide came out the following year.

Great Wall Credit Card (Photo: Bank of China)

However, that was far from fostering a healthy credit card payment environment. In the initial years of China’s credit cards, most merchants were not equipped with the POS machine. As a result, plastic payments were far more complicated and time-consuming than cash payments. Merchants had to call the bank to verify the card number and the client name before plastic payments were allowed.

China UnionPay (CUP) has established a national network of information exchange and multi-bank transaction settlement system. Interconnection and resource sharing are realized in the system of commercial banks, and cards can be used conveniently across banks, regions and borders. With the advancement of technologies, the use of bank cards has steadily risen. According to the Retail Banking Research, a top provider of strategic research and consulting services in London, UnionPay continues to hold the largest share of card payments worldwide at 15 billion at the end of 2017.

(Photo: VCG)

The increasing use of Alipay and Wechat is likely to open up new frontiers for the transitional development of credit cards. Huang Jinyue, general manager of Bank of China’s Bank Card Center, said that the booming mobile payments are driving the rapid growth in card payments as the consumer market expands. Many mobile payment accounts are attached to credit cards, from which banks can improve services, marketing and risk management.

Huang also expects commercial banks to improve smart credit decisions, scenario-based client acquisition, and customized services to support credit cards as financing payment accounts.

(Compiled by Li Siying)