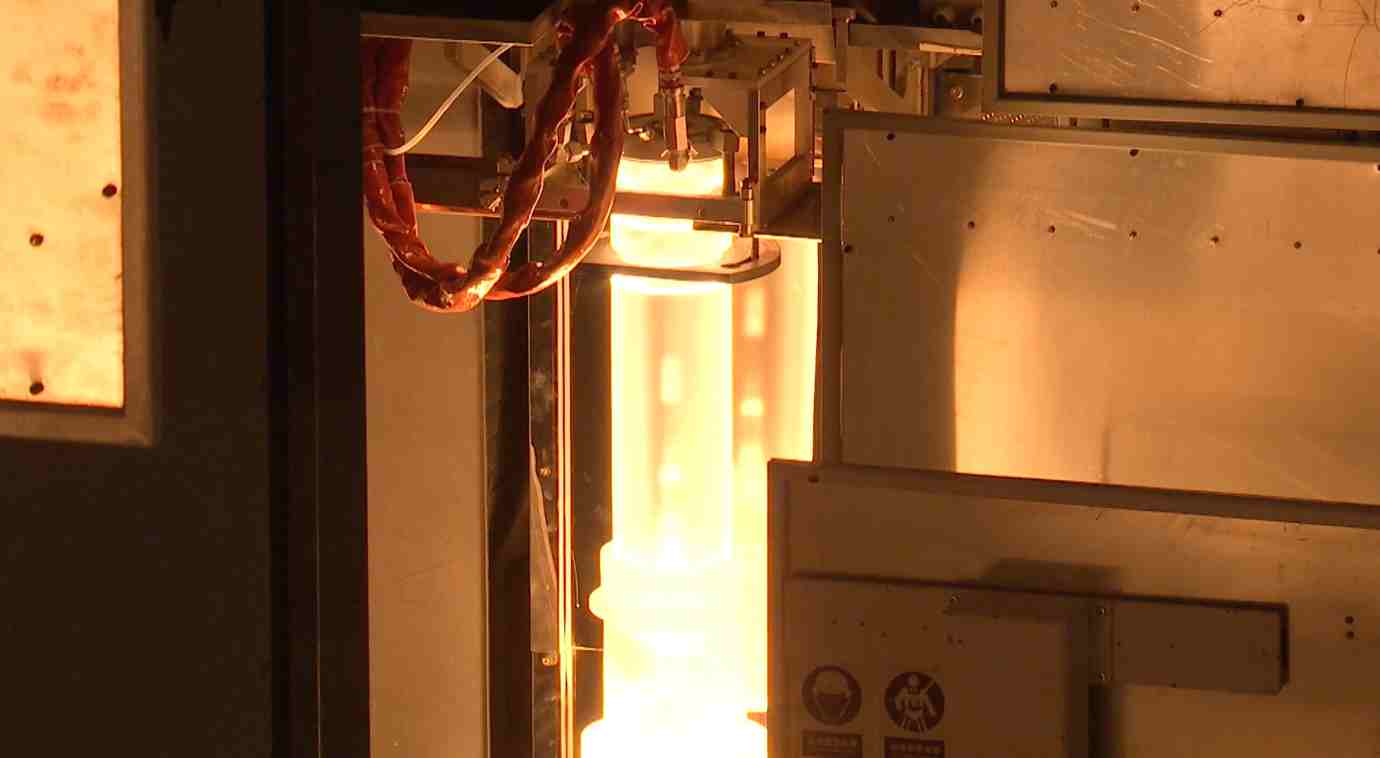

Optical fiber preform, 20 centimeters in diameter, burned and drawn into the optical fiber as thin as human hair to be used in telecommunications. (Photo: CGTN)

Figures show China is the world's largest producer of optical fiber products, accounting for over 50 percent of the global market. With China’s plans to further develop its 5G networks, the production of the optical fiber is expected to increase by three fold. But with the US-China trade tension underway, analysts say China’s optical fiber production is likely to be disrupted.

What is optical fiber?

An optical fiber, by definition, is a flexible, transparent fiber made by drawing glass or plastic to a diameter slightly thicker than that of a human hair, or sometimes even thinner. Optical fibers are widely used in telecommunications due to its nature of transmitting light between the two ends of the glass fiber. They permit transmission over longer distances and at higher bandwidths than electrical cables.

World’s major optical fiber producers

There are about 20 major optical fiber preform producers worldwide in this highly-concentrated market, including Corning, Sumitomo Electric Industries, Shin-Etsu Chemical, Yangtze Optical Fiber and Cable, and Hengtong Optic-electric, according to Global and China Optical Fiber Preform Industry Report, 2017-2021.

The chief among them, China’s Yangtze Optical Fiber and Cable (YOFC), ranks first by global market share (based on output), around 55 percent worldwide, but mostly centered in China, with the reason being, China’s efforts to promote "tri-networks integration," "Broadband China," "5G Construction" and "Internet Plus." These moves are believed to have brought unprecedented opportunities for the Chinese optical fiber and cable market and stimulated Chinese optical fiber preform producers to expand capacity.

China-US trade tension may slow China’s optical fiber production

As the US-China trade tension escalated, Chinese authorities on July 11 this year extended their anti-dumping duties on optical fiber preform from the US and Japan by another three years, though China’s imports of optical fiber preform stand at around 20 percent.

“Many Chinese companies, including ours (YOFC), all have the core techniques, equipment and materials at our disposal. And because of this, technique - and material-wise, we can manage, despite the trade tension. Therefore, the friction is not affecting China’s optical fiber production,” said Zhuang Dan, Executive Director of YOFC.

Zhuang added the Chinese optical fiber market was saturated when the US and Japanese companies came in the first place. Then they set their prices nearly 20 percent lower than those of Chinese products, hence China’s anti-dumping duties on the imported US and Japanese optical fiber products.

Chinese authorities are promising to upgrade their 4G networks to 5G by 2020, which will increase the demand for optical fiber. Nevertheless, analysts say the current US-China trade tension is likely to deter the development of both.

“In the optical fiber industry, China does not rely on foreign resources, nor the foreign markets. This means China can manage on its own, and in the short term, it is beneficial to China’s optical fiber development,” said Professor Liu Chunsheng with Central University of Finance and Economics. “On the other hand, let’s say, if some country takes retaliatory measures, specifically to slow down China’s plans to develop its 5G networks, the optical fiber and cable industry for sure will suffer.”