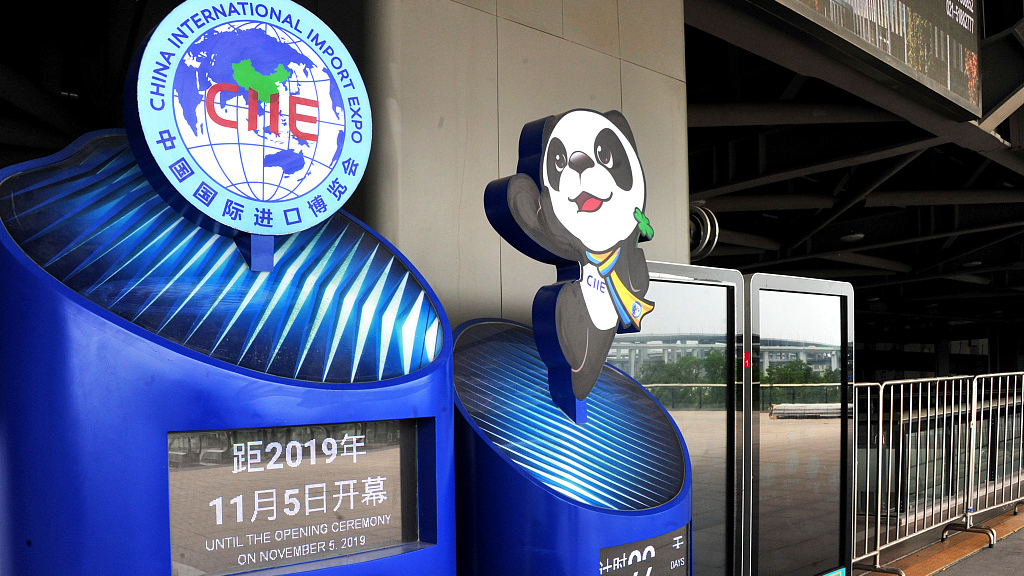

(Photo: CGTN)

People around the world love to shop in a market with stands or mom-and-pop stores like the bazaars in the Middle East or the fish markets in Europe. That could at least partially explain why there are so many trade fairs around the world.

Among the prominent hosts of major events, China is a particularly amazing one, not only because of the famous 62-year-old "Canton Fair" that generates $60 billion contracts annually but also because of the barely 2-year-old Import Expo in Shanghai, which was built from the scratch in merely 20 months and made its stunning debut last November.

A total of 657 foreign exporters signed intentional sales contracts worth $57.8 billion during the expo. Such a remarkable event, specifically designed for imports, is the hard-won outcome of timely policy adjustments and awareness of the responsibility of an emerging economy.

Twelve years ago, policymakers favored exports because they could increase the country's foreign exchange. It takes clear vision and sufficient confidence to decide that imports be promoted as well. In 2007 the Customs Import & Export Tariff was overhauled, and general import tariffs decreased from 9.9 percent to 9.8 percent. Preferential tariff rates were applied to free trade partners, such as the Association of Southeast Asian Nations (ASEAN) members and the 28 least developed countries in Africa.

In that year, the Canton Fair was officially renamed the China Import & Export Fair. One year later, imports increased by 20.8 percent, 1.2 percentage points higher than exports. China's contribution to the world growth increased from 17.7 percent to 23.8 percent. Between 2008 and 2018, the average trade surplus has turned drastically from growing by 26 percent to declining by 7 percent.

Besides the change of leading concepts and principles, the Import Expo also reflects the ongoing economic supply-side reform in China. Chinese manufacturers need to gradually replace obsolete capacities with advanced equipment and technology.

Middle-class consumers are looking for customized products and services for their personalized lifestyles. In about a month, the second Import Expo will be ready to welcome more than 3,000 foreign exporters and an estimated number of 400,000 professional participants.

Similar to the previous event, the over 300,000-square-meter business exhibition floor will be divided into seven sections, including automobile, sci-tech life, medical equipment and healthcare products, and food and agricultural products.

This clearly shows the government's intention to increase supply in the needed areas, while providing export opportunities to the trade partners based on their competitive advantages.

Exhibition hall number one, for instance, was assigned to trade in service last year, when the national import in this area reached $525 billion – a quarter of the total import – from $159 billion a decade ago. Traveling and shopping abroad, the new consumption highlight for well-off urban families, accounted for 73 percent.

From 2011 to 2018, the annual import in transportation and tourism-related services increased by 15 percent on average, and the deficit is up by 33 percent to $303.4 billion — pretty close to $351 billion, the trade surplus in goods in 2018.

Considering the fact that only 10 percent of the population currently holds private passports and can travel abroad, service providers abroad certainly will see much more business potential and sustainable demand in the future.

The Import Expo could also be viewed as a meaningful response to cyclical slowdown and trade challenges.

According to the World Bank, the global GDP growth decreased from 3.17 percent in 2017 to 3.04 percent in 2018, and import growth declined from 5.84 percent to 4.23 percent.

Having initiated industrial transformation in 2013, China slowed down from 7.8 percent that year to 6.6 percent in 2018. As a barometer of the growth prospect, the import of electromechanical equipment has also decelerated from 25.6 percent on average between 2000 and 2007 to 7.3 percent since 2008.

The trade tension with the US has also caused the situation to deteriorate further. To encourage equipment imports and cultivate advanced manufacturing capacity, the government implemented supportive measures, such as cutting import tariffs and related value-added tax.

In 2017 and 2018, the growth of equipment import, which accounts for an average of 46 percent of the total, has recovered to 10.8 percent and 13 percent. Setting up an innovative Import Expo was another major move to facilitate such businesses and diversify import channels.

This year the equipment exhibit, including automobiles, could once again attract the most professional visitors and occupy the largest space as it did last year when exhibitors in the areas brought home intentional contracts worth $28.5 billion or 49.2 percent of all the deals reached in the six-day event.

To a certain degree, a major trade fair in China is a microcosm of political reforms and economic development. If observers and participants have keen eyes and sharp minds, they could always sense the next wave of opportunities.

The Import Expo in Shanghai, a product of the new era, is sending the messages of the money to earn now and the market share to take later. Hopefully, we all are listening.