Photo:CHINA DAILY

It's a pity that current NATO leaders are so short-sighted that they don't seem to consider the long-term consequences of their current policies. It's not clear whether the US administration has a long-term strategy on the Russia-Ukraine conflict.

One big problem with using a war or economic substitutes for a war as a policy tool is that it may lead to terrible and unpredictable outcomes.

I hope it is not too late, but only if Russia and Ukraine both are confident that their security and development are safeguarded can there be sustainable peace in Europe. In fact, the key goal of the policies of the United States, the European Union and NATO since the disintegration of the Soviet Union in 1991 should have been to ensure Russia and Ukraine gain such confidence.

Yet successive US administrations chose to expand NATO further east in direct contradiction to the promises made by the George H.W. Bush administration and without working to reassure Russia that its interests won't be harmed. As for the EU, it could have offered a free-trade agreement or associate membership to both Russia and Ukraine, as it did to Turkey, but chose not to do so for protectionist reasons.

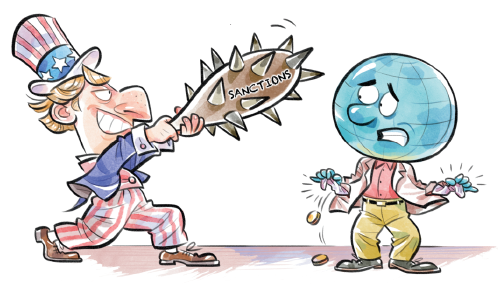

No one knows the impacts the Western sanctions will have on the Russian economy but assume for a moment that the apparent maximalist goals of the Joe Biden administration are achieved-Russia becomes impoverished and isolated. What kind of situation will that create 10 to 25 years from now? Similar to the one that developed in Germany in the 1920s and 1930s?

Perhaps the goal of the sanctions is to effect a regime change in Russia. But an unstable major power with nuclear weapons is scary to even think about. Also, the sanctions will result in many negative, even devastating outcomes for the US and the EU.

The Russia-Ukraine conflict will further strengthen the military-industrial-intelligence state against which former US president Dwight D. Eisenhower warned and which is now dominant in Washington.

The US is overusing its long-arm jurisdiction to impose sanctions on countries because of the dollar's status as the international reserve currency, dominance of the US banking system and the US-centered internet system. But the repeated misuse of this power against major countries such as China and Russia has created strong incentives to establish an alternative global reserve currency, and banking and internet systems.

US economic policy has taken advantage of the status of the dollar, especially in the past 25 years or so. The US has been able to run massive fiscal deficits-borrowed huge amounts of money at very low interest rates for decades. And the Federal Reserve has been able to use very expansive monetary policy to stimulate the US economy without raising inflation, until recently.

The dollar's status has made this otherwise unsustainable macroeconomic policy possible. But suppose, for argument's sake, the interest rate on US Treasury bills increase to even 5 percent, a more normal level, the US federal budget would become absolutely untenable.

Or consider this. As median real wages in the US have not risen since 1979 and wealth has flowed to a small group of elites, average Americans are already unhappy. In such a situation, if the sanctions lead to the collapse of the dollar, Americans would suddenly become much poorer and the US would become politically and economically unstable.

Moreover, the restrictions against the sale of Russian oil and gas will harm not only Russians but also people across the world, including average people in the US and Europe. Poorer people everywhere will suffer the most as the prices of fuel, food, transportation and almost everything else will rise.

Since 1992, Western policies toward Russia have been a story of short-sightedness, selfishness, and missed opportunities. In the first years after the breakup of the Soviet Union, the US and Russia had excellent relations and many US "experts" were working directly in the Kremlin as advisers to the Russian government.

On the advice of these US economists, Russia adopted a "shock therapy" economic program that suddenly privatized almost the entire Russian economy. As a result, Russia's GDP fell by almost half, worse than the Great Depression in the US, hyperinflation destroyed the savings of millions of average Russians, and a few oligarchs "self-privatized" state assets.

Adding insult to injury, the US economic advisers were found to have committed fraud, insider-trading, and misused government funds. It was too bad that Russia did not have the benefit of China's carefully planned, step-by-step reform and opening-up process.

On Feb 9, 1990, James Baker, then US secretary of state said: "We consider that the consultations and discussions in the framework of the 2+4 mechanism (which allowed German unification) should give a guarantee that the reunification of Germany will not lead to the enlargement of NATO's military organization to the East."

But subsequent US administrations chose not to be bound by promises of the George H.W. Bush administration and ceased to treat Russia as a friend and partner. It's crucial that future US and Western policies don't repeat the mistakes of the past, let alone commit worse mistakes.

There is plenty of blame going around. But, as John Maynard Keynes tried to make the victorious allies in 1919 understand, blame is not the important question. To build a peaceful, prosperous world, the important question is how to ensure the security and prosperity of both Ukraine and Russia.

The author is a vice-president and senior economist at the Center for China and Globalization.

The views don't necessarily reflect those of China Daily.