(Photo: China Daily)

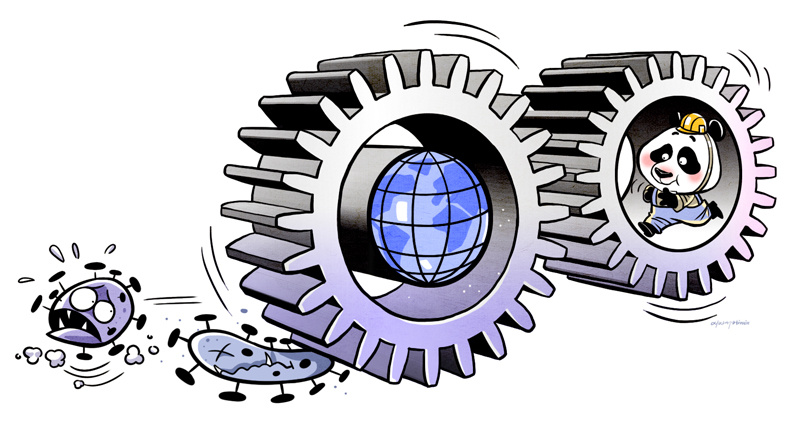

The global recession the novel coronavirus pandemic is certain to bring about will be far deeper and more protracted than the one that followed the 2008 global financial crisis. While many governments have pledged to bolster their economies with unprecedented monetary and fiscal stimulus-despite having already massive public debt-the best they can probably hope for is to stave off economic collapse. If they insist on turning inward-pointing fingers and erecting barriers, instead of upholding international cooperation and economic engagement-even that may become impossible.

Engagement by the United States and China is especially important. In the wake of the 2008 crisis, the global economic recovery got a major boost from Sino-American cooperation, which supported individual stimulus measures (quantitative easing in the US and large-scale fiscal stimulus in China).

US politicians' remarks misguided, malicious

But the global public health crisis has erupted at a moment when bilateral relations-as well as international cooperation more broadly-are at their lowest point in decades, and the US has shown no inclination to improve the situation. On the contrary, some US politicians immediately latched onto the coronavirus outbreak to argue that no country-especially China-should have such a central position in global supply chains.

Moreover, the US administration has seemed more interested in reminding the public that the virus first "emerged" in China than in taking strong action to control its spread at home. This has severely undermined the willingness and ability of the world's largest economies to mount a coordinated response.

The US is wrong to disregard China's potential to contribute to resolving the global public health crisis. It is also wrong to expect that the pandemic will weaken China's position in global supply chains.

Even if more regionalized and diversified supply chains would reduce risks, China retains considerable competitive advantages in many areas, such as electronics and machinery and equipment manufacturing. It cannot be replaced, at least not in the near term.

This is not to say that China's role in global supply chains will not shift. But that has been happening for a decade, with a large number of low value-added manufacturing jobs being transferred to neighboring countries.

But far from weakening China's position, this has enabled it to climb the value-added ladder. The Yangtze River Delta region and Guangdong province-regions that used to produce garments and shoes, and assemble electronics-have become hubs for high-tech innovation.

Rising consumption has reduced China's reliance on exports

Also, China has worked to boost domestic consumption, thereby reducing its reliance on foreign demand. As a result, the world may now be more dependent on China than China is on the world. I believe that the pandemic will strengthen this dependence, not least because China is months ahead of most countries (at least) in getting a handle on the virus and reopening its economy.

To be sure, China's stringent lockdown measures have extracted high economic costs, which could possibly amount to an 8-10 percent decrease in GDP in the first quarter. But they also enabled the country to stem new infections at a time when the virus was just reaching the rest of the world.

Already in mid-February, China began working to restore production in an effort to stabilize global supply chains. And thanks to that, China has avoided the stock market turmoil seen in the US, where infections are rising fast and lockdowns are being imposed.

Because of the Chinese government's resolute action-which, to be sure, followed some initial missteps by local authorities-China may become the first country to restore economic growth, while the rest of the world is mired in a deep recession.

Unlike after the 2008 global financial crisis, it looks like China's government does not have to plan even more massive new investment spending. It should be enough to follow through on existing infrastructure-investment plans-including the construction of ultra-high-voltage power grids, intercity high-speed railways, and 5G networks-while taking other steps to support economic and employment recovery, such as subsidies and tax exemptions. With a fiscal deficit of less than 3 percent of GDP, China can certainly afford such measures.

Investments to boost high-tech sector

These investments will help China to build on recent progress in even more high-tech sectors, including big data, artificial intelligence, the internet of things, and the industrial internet.

Which in turn will deepen China's integration into the global technological supply chain. And not even a Sino-American decoupling can stop technological exchanges between China and the rest of the world.

Neither US resistance nor the pandemic will stop China from opening up its services sector or becoming an increasingly attractive export destination for advanced economies and emerging market economies.

Indeed, at a time when some might be tempted to turn inward, China remains as committed as ever to economic globalization.

The trade, investment, and growth opportunities that this commitment generates could well be a godsend for struggling countries in the aftermath of the coronavirus outbreak.