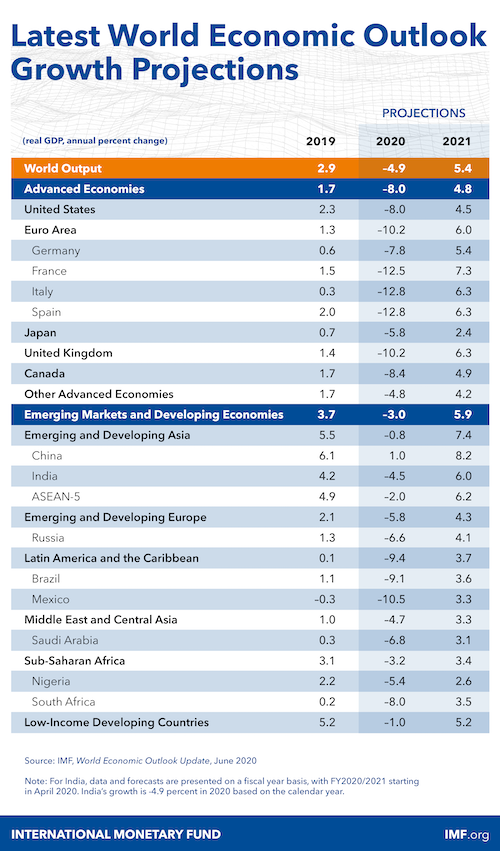

In its latest World Economic Outlook, the International Monetary Fund (IMF) projects global growth to contract 4.9 percent in 2020, 1.9 percentage points below its own forecast in April.

This negative projection mainly resulted from the coronavirus pandemic. The COVID-19 crisis has caused far wider and deeper damage to global economic activity than hoped, while the recovery seems more gradual than anticipated, even if many economies have already begun to reopen.

But among all the economies of the world, China stands out as the only major economy now expected to show positive growth in 2020. This is credited to the country's orderly resumption of work and production after a string of effective and efficient measures to control the pandemic.

China's official data released on Sunday saw industrial profits rebound 6 percent in May. It was the first rebound since November last year, reversing a 4.3 percent fall in April. The rebound strongly testifies to a recovery of China's economy and smooth resumption of industrial firms, showing the country's economic growth remains resilient under controllable impacts from COVID-19.

Under the shadow of the coronavirus pandemic, the economic perspective is very much dictated by countries' COVID-19 responses. Obviously China's swift response to the pandemic has led its economy in a positive direction and gained credit from international organizations.

Graphic: IMF

It is fair to say that foreign capital still holds confidence and interest in investing in China.

"Despite the difficult global environment and uncertainties caused by the COVID-19 pandemic, European companies overall remain strongly committed to China, which remains a top three investment destination for 63 percent of respondents," said Denis Depoux, global managing director of Roland Berger, according to a business confidence survey released in June by the European Union Chamber of Commerce in China.

Another survey, released much earlier this year, the 2020 China Business Climate Survey Report by the American Chamber of Commerce, also pointed out that for most respondent companies China remains a key priority destination and 83 percent were not considering relocating manufacturing capacity or sourcing outside China.

This is a strong rebuttal against so-called "decoupling" from China by certain US politicians and their appeals to cut off the supply chain and shift factories to their own country.

After all, the main considerations of profit-driven investors are factors like market demand, business climate and favorable policies.

China, meanwhile, has issued favorable policies to further open and attract foreign investment. More free trade zones, enforcement of the foreign investment law and a shorter negative list all reaffirm China's resolve to keep opening its economy.

In the first five months of this year, China's foreign direct investment was down 3.8 percent year-on-year due to the pandemic.

The country thus reacted quickly on June 24 announcing a new negative list for foreign investment that would be further shortened and improve the level of openness in the service, manufacturing and agricultural sectors.

As a Wall Street Journal article headlined "China a bright spot for US in gloomy global trade picture" reported, "China looks like it could be the biggest engine of global GDP growth in 2020 and maybe 2021," Craig Allen, president of the US-China Business Council, was quoted as saying.

The COVID-19 has surely dealt a heavy blow to the global economy, but with all these promising signals, it is notable that foreign capital and investors are still full of confidence in China's economic recovery and the opportunities that accompany the recovery.